British politics isn't exactly enjoying its finest hour. With contrasting inter-party views aired publicly, PM May deciding enough's enough by handing over her tenure at no.10 and then there's the elephant amongst it all, the catalyst: Brexit.

Wherever you sit on the above, there's no escaping the challenging circumstances, which the ongoing Brexit narrative has brought upon the UK manufacturing industry. Uncertainty amongst what tariffs UK businesses will face. Uncertainty on the physical borders, including free movement of staff and goods. Uncertainty on how long goods will take to reach their destinations. This is the stark reality that faces the UK economy as a whole.

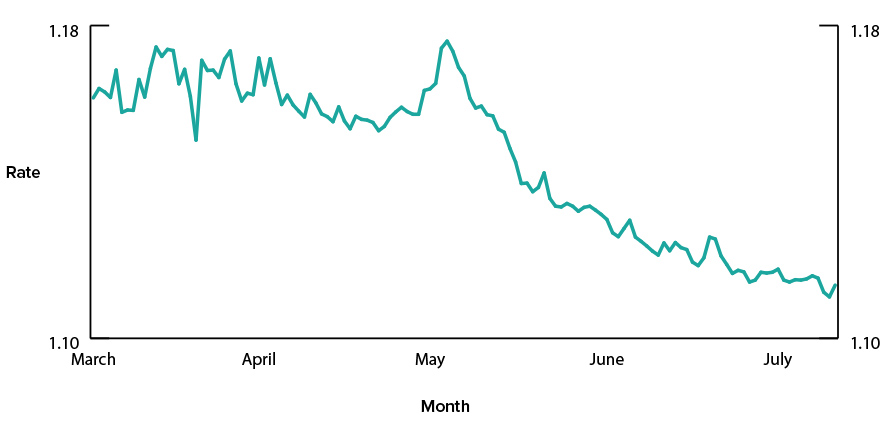

There's also the dilemma of how currency reacts to this ever-changing script and what this means for an industry already facing a host of other possible woes.

What we've learned so far

Amongst the constantly shifting negotiations, last minute flights to Brussels and a PM who fought to strike a deal, the pound has, predictably, fluctuated over the past few years.

Only last month, Boris Johnson was accused by senior Tories of pushing to quit the EU without an agreement in October. This subsequently, like in all other conversations regarding a no-deal, crushed GBP - to its lowest ranges of 2019 in fact. We can be thankful for this to some degree; no-deal talks, further delays to proceedings and uncertainty around a deal have triggered patterns amongst GBP. Whenever these topics surface, the currency typically weakens and that's become one of the few certain consequences of these talks.

As we steadily approach yet another date to leave in October, the question still remains: deal or no deal?

"A no-deal Brexit would be nothing short of commercial suicide"

Seamus Nevin, the chief economist with Make UK, which represents some of the country's largest manufactures believes the notion of a no-deal would cause British firms to lose customers and British people to lose their jobs. Pressure is building on businesses to stockpile goods, consider moving operations to mainland Europe and rethink their entire strategy - all at spiralling costs.

Whilst this is unravelling, the pound is nervously awaiting the UK's next move, because whilst a no-deal looms, the currency has headed one way in recent months - down.

British Pound / Euro (2019)

Costs associated with a no-deal

It could be argued the manufacturing industry has been dealt the short-straw. Whilst other UK-based businesses may only experience slight legislative amends and currency fluctuations, the hard truth is a no-deal could trigger double-bubble costs for the manufacturing industry: currency and huge logistical changes.

A snapshot of what that could look like:

- Tariffs - enforced by the EU

- Stockpiling goods - to manage uncertain delivery times and costs

- Relocation fees - should the cost of operating in the UK outweigh an overseas operating

- Legal costs and admin costs

- A weakened pound - costs of imported materials increasing

It could be argued there's been an amount of scare-mongering to aide political agendas but with the facts present, and a pound that's weakened on these facts, it's hard to argue that a no-deal isn't anything short of disastrous for UK manufacturers - albeit in the short-term.

Managing currency fluctuations

Currency fluctuations remains one of the biggest hurdles for our clients, and when purchasing in bulk, a slight deviation in the rate can hinder their bottom-line.

Whilst we have no control over the rate and how the markets react, you can take actions to managing the risk and it's no complicated.

Spot trade

You simply buy or sell a foreign currency on the day. Whether you are booking over the phone or online, we will quote you an exchange rate and cost of settlement. This is our most-straightforward and efficient product - you know exactly how much sterling is required to settle and the amount of currency you'll receive. Whilst this service does not mitigate fluctuations day-to-day or even during the day itself, our experienced and knowledgeable traders are here to guide you to reduce this risk.

Forwards

A forward is a contract to purchase an amount of foreign currency at an agreed rate, either in parts throughout or in full at the end of the lifetime of the agreement. As there are no guarantees in how the market will move, forward planning allows you to reduce the risk and lock-in an agreed rate. The downside to this approach is that the exchange rate moves to a better rate than the fixed exchange rate you've already agreed.

No one knows what impact Brexit will have on the manufacturing industry in the long-term. However, the overshadowing no-deal scenario is causing widescreen issues, which in turn is weakening the pound to harmful levels for UK businesses. In the meantime, the near-term future of our manufacturing industry remains in the hands of the UK politicians.

Written by: Sam Wood

Sam is a key member of WhitesPay’s Account Management team. He joined the business 2013 and has a proven track-record for assisting our import clients and their cross-border payments.